This is Part 2 of the “Foundationology of Migrationology” series.

If you are just joining, you might want to check out “How Failing the SAT Helped Me Make Enough Money to Travel the World.”

It’s difficult to make and save money when you float through life.

Spending builds and feeds off itself. Money disappears.

But it’s not difficult to make and save money when you live wisely.

Before we get started though, there’s no way around first making some money. There’s no way to save money if you don’t make money in the first place – and it takes work. You and I probably won’t win the lottery (and we sure aren’t going to wait for it).

The good news is, if you have a way to make some money (job, business), you can use effective strategies to save it.

Think about your goal

In fact, your goal (your migration) doesn’t even need to be traveling or seeing the world. Your goal should be your passion: what you want to be doing, where you want to be doing it.

What is your goal? If you can keep it in the front of your head at all times, it will help you to keep focused, to live in a more optimized way to accomplish it.

Once you have your goal set, that’s the only way you can start to take command and save money to accomplish it.

1. Be financially smart

Don’t buy things on credit when you don’t have the money to pay it back.

Sure you have the opportunity to pay it back as time goes on, but that time it takes to pay back, will hold you in jail.

It will force you to remain stabilized and work to pay off something that most likely brought short term gain / benefit, something that I’m guessing is not your passion.

Get exclusive updates

Enter your email and I’ll send you the best travel food content.

I ONLY used a credit card in order to build my credit score (not to buy things I just wanted).

2. Transform habits to occasional treats

When I was in University I got into the habit of drinking a soda (Dr. Pepper to be exact) almost everyday at work.

I decided to quit (for the most part) drinking soda altogether in an effort to save money and get rid of unnecessary intake. I still drank a soda every now and then, possibly once a month. Soda became more of a treat for me, it even tastes better when you don’t drink it so often.

This is just an example, but there are many things that with a little effort can be transformed from a habit to a treat. Not only will it save money, whatever you transform will turn into something more special when you do it.

You don’t need to transform everything, but if you think you can do it, go for it!

3. Lower your rate of need or adapt to it

Receiving a bonus on a paycheck is not an excuse go out and have a “big night,” or blow 3/4 of it the next day on something you really wanted. Save it.

Train yourself to need less. Utilize self control to modify the things you really need. No, you don’t need 23 t-shirts. 6 is probably sufficient.

Throughout university I was addicted to stylish clothes and designer jeans (you might not believe me now!). I didn’t like shopping that much, but enjoyed searching for clothes online or at discount outlets. I would frequent used brand name clothing stores and sometimes line up at stores like Last Chance (fancy name-brand clothes returns) to get incredible deals.

Even so, I kept just 4 pairs of pants and 6 shirts to wear. The rest, I would sell (I didn’t NEED anymore, despite how cool they were). On top of that, clothes that I bought were almost all an investment. I might buy something, wear it a few times, and sell it used on e-bay for more than I purchased it.

“If you lower your rate of need, it won’t take long for you to adapt to it.”

4. Don’t buy depreciating goods

Depreciating things lose value, fast.

I’m talking about unnecessary or entertaining items, impulse purchases, or things that are straight impractical but maybe cool.

I’m NOT talking about personal value here, I think there are plenty of things that we have / buy that lose their value to the world after being purchased, but may mean something to us. It’s sometimes best to question yourself though.

5. Junk to you, treasure to someone in the world (find them online)

Way too many people have way too much stuff that uselessly sits around.

I worked at a glorified waste management job for 2 years and saw people holding on to valuable things that they will never ever use ever again for anything (despite lying to themselves). I was also the recipient of many things thrown away that were valuable.

Sort through your closet, any clothes you really like, but will never wear again? Any gadgets, electronics, books, or things you hold onto because you think it might be useful sometime?

Spend time to figure out how to sell things on e-bay and Craigslist, where the world is your market. If you need help to get rid of stuff and want to make money from it, I’d highly recommend taking a look at Sell Your Crap: Turn Your Clutter into Cash*. You’ll make money and learn in the process!

6. Cut back on monthly fees

Monthly fees are the enemy.

You don’t need entertainment subscriptions to everything. Choose a few necessary subscriptions you think are really beneficial and after narrowing it down, go back AGAIN and ask if you REALLY NEED it, or not.

7. Take advantage of your personal skills, passions and opportunities

Everyone has individual skills, opportunities and circumstances that can be leveraged and used advantageously.

Use your skills to pursue what you do best and use your opportunities to take full advantage of getting in to a position where you want to be.

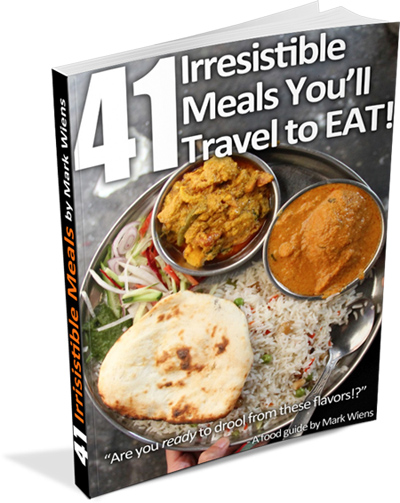

I enjoy selling things, as evidence from my previous e-bay sales. Though I don’t do much of that anymore, I’m looking for opportunities now to get back doing some sales. I recently created the Eating Thai Food Guide that sells for $7 per copy, something that took time and effort to create but without any major costs (other than eating…a lot!). And by the way, eating is my passion!

But what are your skills? Might they also be your passion or hobby? Find ways to use them to your saving advantage.

Final thought

I did initially start traveling the world with some money, but using effective strategies for saving over my 4 year period of attending university, I was able to accumulate enough money to leave as soon as I graduated.

I set off to travel the world about 3 years ago with around $8,000 USD to my name. I haven’t stopped traveling, but I have been able to make more money in other countries and stretch that initial cash (read more about how, in the next article – coming 19 July 2011).

I’d love to hear your questions or comments below.

————————————————————————————————————————————————-

This is Part 2 of the Foundationology of Migrationology series.

Don’t miss the next article (19 July 2011): Migrationology: The Sustainable Way to Travel Long-Term

Enter your e-mail below to sign up for my (FREE) monthly newsletter to get more long term travel tips and advice on how live a life to pursue your passions.

Stay tuned for the next articles in the series!

- 5 July 2011: How Failing the SAT Helped Me Make Enough Money to Travel the World

- 12 July 2011: 7 Simple (but Effective) Strategies to Save Money to Travel

- 19 July 2011: Migrationology: The Sustainable Way to Travel Long-Term

- 26 July 2011: How To Live Like a VIP in Bangkok for $285.06 Per Month

- 2 August 2011: Migrationology: Living With Future Intentions

*Affiliate link – I’ll make a percentage, but I stand behind all recommendations on Migrationology.com.

Get exclusive updates

Enter your email and I'll send you the best travel food content.